- Have any questions?

- hello@move-engine.com

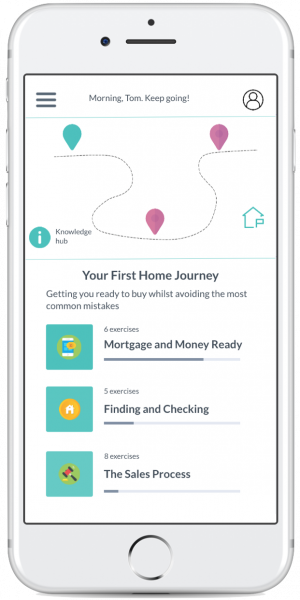

Feel ready to go out and buy your first home

Meet the app that prepares you to start house hunting with confidence.

Understand how to get a mortgage

Avoid mistakes and hidden costs

Feel prepared & confident to buy

Say good bye to feeling daunted about what's next

Discover a new way to get prepared

We know you'll have a million questions at every step of the process

We're here to help you get the answers you need to questions like:

Where should I start with checking I’m ready to buy?

How do I confirm what I can borrow and get a mortgage?

What are all the costs, and when will they need to be paid?

What is the house buying process?

What if I lose my job or can’t work?

What else do I need to know?

Three steps to set you up for success

Step #1: Get The App & Take your Readiness Quiz

The first step is to get the app and figure out your readiness to buy. When you join our app the first step is to complete a fun quiz to check where you are at. Also, learn about how best to get prepared.

Step #2: Get help to prepare for each step

Use the apps short training videos, gamified checklist and recommended articles to get prepared before each step. From mortgages to move costs to what to ask on viewings. Learn each step as we guide you through the process.

Step #3: Buy with confidence

Buy knowing you are money and mortgage confident and ready for the moment the right house comes along.

"great advice and was very helpful. Answered all my questions and pointed me in the right direction"

Lenka Danisova - First-Time Buyer

Taking on a mortgage and buying your first home is a big decision

Here’s what it looks like when you feel prepared and informed:

Make decisions with confidence.

Understand the different types of mortgages & schemes available, the financial implications, and where to go to get the best advice for you

Avoid hidden costs.

Carefully plan for the fees and likely extra costs at every stage, so you know what you need to budget for and how to avoid nasty surprises.

Use everyday language.

Don’t let confusing industry jargon stress you out. Know what questions to ask, and get the answers you need, in plain English.

Work with recommended professionals.

Find the people, advice and services you need to feel in safe and trusted hands. Our friendly team is here to help and support you every step of the way.

Get just the right amount of knowledge.

Get enough information about the mortgage and home buying process that you can take the next steps feeling confident, not overwhelmed.

Stay in control.

Know what to expect at every step of the journey, so you can make informed decisions, feel fully prepared and stay in control of your finances and future.