Our 7 Step Guide to Buying a House

Welcome to our guide to buying a house. If you are trying to work our how to buy a house this guide is for you. Not only does it explain the most important steps in buying, it is a blueprint for the order in which to do things to save time and money.

By following this plan you will avoid some of the most common mistakes people make especially first-time buyers. We’ve tried to keep it high level so that you can come back and reference it later. You can also dive into each stage to learn more. The helpful timeline gives you an idea of when to start each stage.

8-12

Months

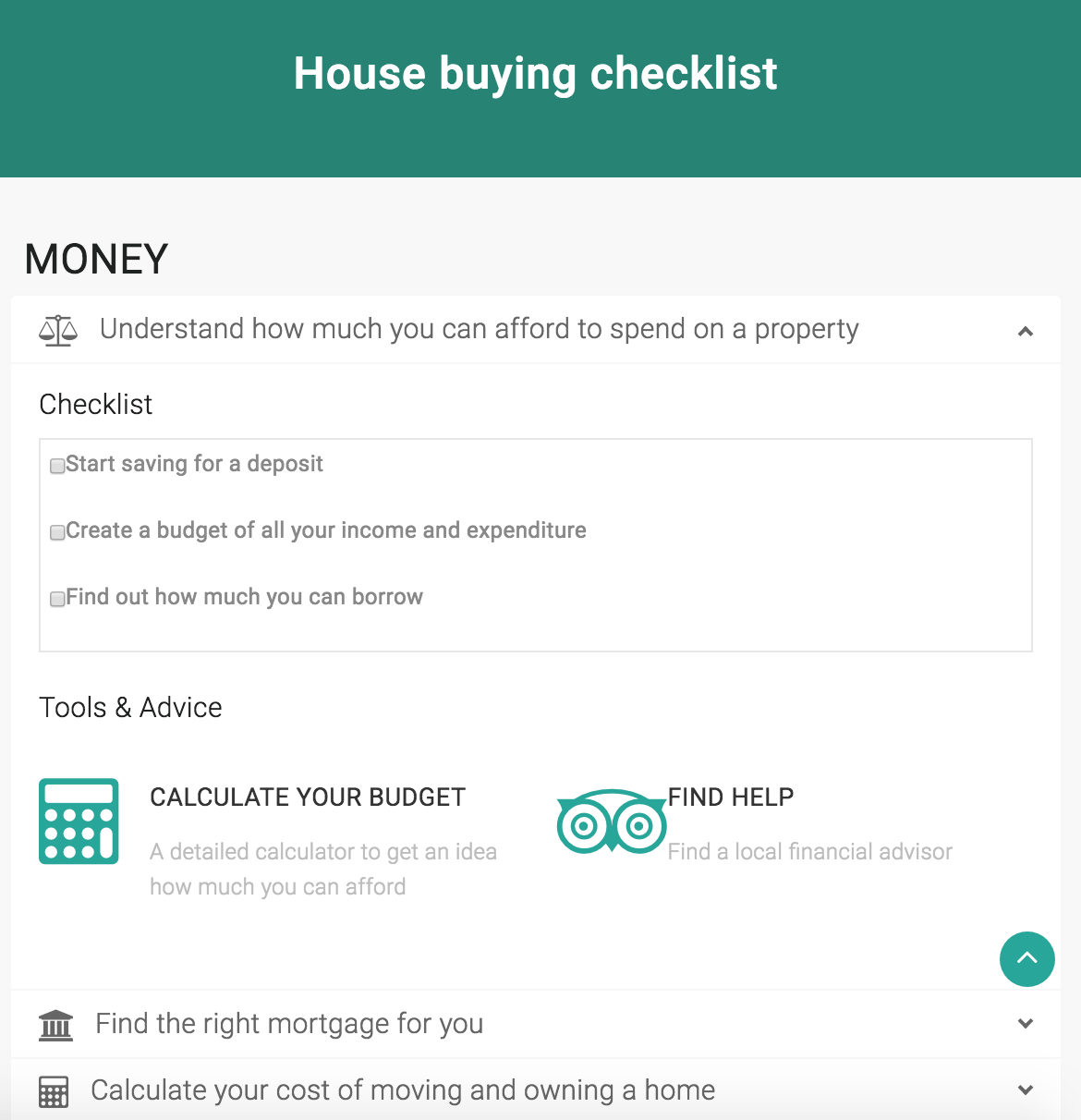

FIGURE OUT YOUR FINANCES

The best place to start is working out your finances. There are some key questions you need to answer including:

- How do I get started?

- Will you need a mortgage?

- How much will it cost each month?

- How much is the property you want to buy?

- How much can you borrow?

- What savings will you need for a deposit and move costs?

- Will you qualify for a mortgage?

- What should I do next?

6-8

Months

NARROW DOWN YOUR SEARCH

It’s time to go online and start narrowing down your search. This is an exciting time and many of us enjoy looking at properties on our favourite property websites such as Rightmove and Zoopla.

It’s time to answer some of the following questions:

- What type of property is best suited to what you need?

- What areas could you buy?

- Do you want to buy a new build property?

- Will you need help from any of the government schemes such as Help to Buy?

- Are you saving as much as can ready for move costs and owning your new home?

- Are you taking the time to learn about mortgages and the next steps in the process?

Enjoy surfing the web looking for your potential new home whilst saving as much as you can.

4-6

Months

GET MORTGAGE ADVICE

Now you have an idea of what you want to buy it’s time to make sure it’s possible for you. Understanding mortgages can be complicated and time consuming but luckily there are lots of different ways to get help.

You can talk to your bank, use an online broker or you can talk to a mortgage adviser who can save you time and talk to you about everything for your circumstances.

One thing to be aware of is lenders will not just look at your income but your monthly expenses, lifestyle, credit commitments, loans and credit history to determine if they will lend to you. It can be hard to figure everything else which is why we always recommend getting advice.

3-4

Months

HOUSE HUNTING

Now you know what you can borrow it’s time to start going out and viewing properties to find the property you want to buy. You can register with local estate agents to be the first to hear about properties before they hit the internet. Also, make sure you sign up for email alerts from your favourite property websites.

Don’t just rely on the internet, now you have your finances in place estate agents will be happy to show you properties. Remember when on the viewings its a good idea to have a checklist. Luckily we have put together our viewing checklist to help you.

It’s also a good idea to prepare for the next steps in the process such as which conveyancer will you use.

Check out our 25 mistakes to avoid when buying your first house ebook at the bottom of this page to make sure you are on the right track.

2-3

Months

THE SALE

You’ve found the property you want to buy so now you need to negotiate an offer to buy the property.

Once the deal is agreed it’s time to get the legal work carried out by a conveyancer, apply for your mortgage and arrange a survey to check the property out. It’s a busy time which is why our advisers are here to guide you!

The length of time a sale can take can vary depending on how many other properties are involved (known as the chain), whether the property is new build and what the sellers circumstances are. We recommend finding out as soon as possible how complicated your sale looks so that you can plan accordingly.

Read our 6 Reasons Why a Move Engine Recommended Mortgage Adviser can take your stress out of the sale

2

Weeks

EXCHANGE CONTRACTS AND COMPLETION

Good news. You are nearly there! The next stage of the sale is known as the exchange of contracts. At this point both parties will be legally bound to the sale. Many people are surprised to learn that up to this point the sale can fall through. There are a few things for you to sort out like buildings insurance on the new property and securely transferring the money for the deposit.

During the exchange process all parties will agree a completion date. Completion is basically the date when everything becomes official and you become the legal owner of your new home and can pick up the keys. Often this can be within a couple of weeks or even days of exchanging.

During this time you will want to start the next stage which is preparing your move.

0

Weeks

MOVE

Great news you are about to move in. Around two weeks out its time to plan moving house. From packing and removals to having a good clear out of your belongings.

During this time it is worth thinking about arranging any works you want to arrange for when you move in. This could be simple things like cleaning, basic repairs, decorating or furniture.

You should also think about what will happen with your current property, especially if you are renting you may want to get someone else to clean it so you can get your deposit back and focus on your move.

There will be lots of companies to notify about your move and it is always worth comparing your energy and broadband providers to get a good deal and help save some money.

Finally, pick up the keys to your new home and enjoy!