How to buy a house

You’ve decided you’re buying a house, so what happens now? The entire buying process can take anything from six weeks to eight months (sometimes longer). Let’s work through the steps to buying a house, so you know what to expect and when.

You’ve decided you’re buying a house, so what happens now? The entire buying process can take anything from six weeks to eight months (sometimes longer). Let’s work through the steps to buying a house, so you know what to expect and when.

Do you have a property to sell?

If you do, you need to get it ready to go on the market. Appoint an estate agent and establish what your properties current value is, whether it needs any work before it can go on the market and get an indication of how long it is likely to take to sell.

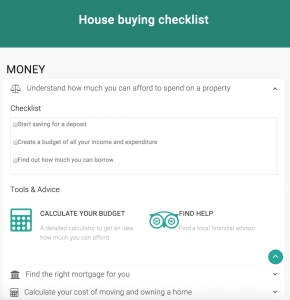

What’s your budget?

Be realistic about this. How much deposit do you have? Do you know how much can you afford to borrow? You might want to check out the government’s Help to Buy schemes if you need help to boost your budget. Having a handle on your finances is vital in the house buying process, as it will decide if, what and where you can buy.

If you are buying a house with a mortgage, then this is the time to investigate how much you can borrow. Don’t just go to your bank to get a mortgage; there are lots of great deals available from a multitude of lenders.

Using comparison websites such as moneysavingexpert.co.uk or moneyfacts.co.uk and mortgage calculators will give you a good insight into what you could borrow and how much it will cost you.

Remember there are many things that will affect what you can borrow. Mortgage providers will calculate how much they will lend based on a number of factors, including your income and your outgoings.

Your spending habits, employment status, and your credit score will all be under examination, as they see if you can keep up with repayments if your situation changes or interest rates increase.

However, if you don’t want to do the legwork yourself, you can engage a broker to work on your behalf to establish what you can borrow and find the best mortgage deals for your circumstances.

Don’t forget moving costs!

It can be surprising how much moving home actually costs in addition to the actual property itself.

You will have legal fees and may need to pay stamp duty (tax) as a percentage of the property if bought in England or Wales. Remember if you are selling the estate agents fees will need paying too.

Plus you might want a structural survey to check for any hidden problems and don’t forget to factor in the costs of a removal company or the hire of a van if you plan on doing it all yourself.

Get a mortgage in principle

Before your official mortgage application, a lender can give you a mortgage or decision in principle. It’s a certificate or statement from them to say that ‘in principle’ they will lend a certain amount to you based on the information you have provided.

At this stage, you should get your finances in order, so when you have an offer accepted you are ready for a full mortgage application.

Being able to act quickly means that you are in a stronger buying position and will hopefully avoid the heartache of a seller accepting another buyer’s offer because they can move the sale forward quicker than you.

It is common practice for an estate agent to require proof that you will be able to secure a mortgage for the property you want to make an offer on.

While a mortgage in principle is not a guarantee, providing you have been truthful with the information you have supplied, it is a reassurance for estate agents and sellers that you are serious about buying a house.

As a result, you are a more attractive buyer, and you increase your chances of having an offer accepted.

Location, location, location

Now you know what your budget is and you are armed with a mortgage in principle, it’s time to start your property search.

You might already have a clear idea of where you want to live and the type of property you want to buy.

However, it is still important to do your research. Get to know the property market in the areas that you are interested in buying, talk to the local estate agents and visit as many properties as possible.

Find out about the schools, community leisure facilities for the neighbourhood, you can even check out the crime rates and broadband speeds.

Compare house prices in the area; is there an up and coming road, or one street that seems significantly cheaper than another? How quickly are certain properties selling?

When you find ‘the one’ scrutinise every aspect of it. This house is going to be your home, so you should love everything about it.

Have a viewing checklist to remind you what you should be looking at, for example, condensation, cracks, brickwork, the boiler/central heating system, guttering etc.

Visit at different times of the day to give you a real feel for the area and your potential neighbours. What’s the commute to work like? Is public transport easily accessible? Think about whether this property will meet your needs in 5, 10 or 15 years’ time? Often the first viewing is not enough time for all these checks, so consider a second viewing to be sure if possible.

Making an offer

Finding a property that you want can be both exciting and stressful, especially when you make an offer. If you’ve followed these steps to buying a house, you will have given yourself the best chance of having your offer accepted. A strong buyer is one that has their finances in order and is ready to start the process of buying a house.

Be prepared to negotiate on price. Decide before you make your offer, the maximum price you will pay for the property and its fixtures and fittings; it will make the process much easier.

Hire a solicitor or conveyancer

You will need the services of a solicitor or conveyancer to manage the legalities of buying your house ideally before you have an offer accepted.

As soon as your offer is accepted, the estate agents managing the property sale will require the details of the solicitor acting on your behalf. Your solicitor will conduct searches with the local authority and the Environment Agency to ensure there are no significant issues with or impacting the property you want to buy. They will also liaise with the sellers’ solicitors and do the legal work to transfer ownership to you and handle the transfer of money between all parties.

Offer accepted? Now for the full mortgage application

Once your offer is accepted, it’s full steam ahead. Go back to your broker or mortgage company with the agreed offer and complete the mortgage application process.

Valuations and surveys

Your mortgage provider will require a valuation of the property you are buying to confirm that they can lend against it. A mortgage valuation only looks at the property superficially as your lender will need confirmation that if you default on your mortgage payments, they will be able to sell the property to recoup their loan.

If the property is valued at less than what you have offered, then you will need to reduce your offer and/or withdraw from the purchase.

At this stage, you may want an in-depth survey of the property to alert you to any potential problems before you complete the sale. There are several different types, each conducted by a qualified surveyor, offering different depths of survey. A Condition Report or a Homebuyers Report will provide you with general insight into the condition of your property, however opting for a Home Condition Survey or a Building Survey will give a more extensive in-depth survey and detailed report.

If you are advised of significant structural problems, you are in the position to withdraw from the purchase or renegotiate the deal and/or price you are willing to pay based on the costs involved to make the necessary repairs.

Exchange contracts

Contracts are exchanged once the surveys are complete, your solicitor has conducted and is happy with the searches, a formal mortgage offer has been received, and your initial deposit is in place.

At this point that you are legally committed to buying the property and they are legally committed to sell it to you; neither party can pull out of the sale. If you do change your mind, make sure to do it before you reach this stage or else you will forfeit your initial deposit.

If you haven’t already set a completion date, your solicitor will want to confirm one now. This is the date the keys get handed over, and you can move in.

Deposit

Your solicitor will need a deposit before you can exchange contracts on the property. It may come from the sale of your existing property (in which case your solicitor will take care of it), or it may be transferred from your savings, either way, make sure you know exactly where it is and how to access and transfer it.

Buildings insurance

You will need to have buildings insurance in place before you can exchange contracts. Most mortgage lenders will require evidence that you have cover arranged to start from the date of exchange, which is when you legally become responsible for the property.

Before completion

The time between exchanging contracts and completing the sale is when you can negotiate on things that have not yet been agreed, e.g. the seller may offer you their fridge freezer, curtains or garden shed!

It’s also time to start planning your move. Write a checklist of everything that needs to be done from clearing out the loft, to rubbish tip runs, to packing your belongings, to hiring a removal company and telling people that you are moving. (Top tip – moving on a weekday is cheaper if you need a removal company).

During this time you can start contacting utility, TV and broadband suppliers. You can ask for the current supplier details from the seller’s estate agent. You might find it easier to transfer the existing utility accounts for the property into your name; you can look at switching suppliers at a later date.

During this period your solicitor will be advising land registry that they are in the process of transferring ownership of the property and liaising with your mortgage lender to ensure everything is in place for completion.

Completion

On this date, you are officially buying a house! Your solicitor or conveyancer will manage the money and property deeds, and you will take ownership of your new home. The seller will have vacated by the agreed time of completion (usually midday), so you can collect the keys from the estate agent and move in.

It’s not over yet…

While you may have completed the sale, there are a few loose ends to tie up after completion. Your solicitor will pay the stamp duty on your behalf, register the change of ownership with land registry, and send the title deeds to your mortgage provider. You will receive a statement that details all the legal costs and disbursements, as well as the property purchase price and stamp duty, plus a cheque if you are owed a refund.

Finally, don’t forget to register to vote at your new address, it doesn’t happen automatically, and make sure you’ve used Royal Mail’s Postal Redirection service to ensure you don’t miss any important letters or bills sent to your old address.

In reality, many of the processes of buying a house will all seem to happen at the same time. Getting familiar with these steps will help you manage the process and reduce your stress levels!

Next Step

Plan buying a house with confidence using our complete house buying checklist.

Each step of the house buying process is covered in more detail along with help, advice and online tools.